(As of December 8, 2020)

What is CEWS?

The CEWS is a wage subsidy for employers who experience a revenue decline. The subsidy can apply to the wages of active or inactive employees.

The program was modified repeatedly since it was first announced on March 27, 2020. The first piece of legislation, Bill C-14, established the rules for the first four claim periods. An extension to the program was announced in May and was followed by Bill C-20 which introduced new rules, expanding eligibility for companies who experienced a smaller than 30% decline in revenue. The federal government further expanded the program through Bill C-9, which modified the total subsidy amount and extended the program to June 21, 2021.

| Original | Expansion | Extension |

| Bill C-14 | Bill C-20 | Bill C-9 |

| Periods 1-4 | Periods 5-7 | Periods 8-10 |

| March 15 – July 4 | July 5 – Sept. 26 | Sept. 27 – Dec. 19 |

| Must demonstrate revenue decline of at least: Period 1: 15%Periods 2-4: 30% | Subsidy proportional to decline in revenue Base subsidy + top-up for >50% revenue decline | Subsidy proportional to decline in revenue Gradually decreasing base rate + top-up for most-affected |

| Subsidy: 75% of wages Max of $847 per employee per week | Max subsidy: 75% of wages Max of $847 per employee per week | Max subsidy: 65% of wages(40% base + 25% top-up)Inactive employees aligned with EI (max $573) |

| Safe harbour rule for periods 5 and 6 | Subsidy extended to June 21, 2021 | |

| General approach or alternative approach to revenue decline | General approach or alternative approach to revenue decline |

In the fall economic statement, the federal government indicated that it intends to restore the maximum subsidy amount to 75% for claim periods between December 20, 2020 and March 13, 2021. Legislation enacting this change is forthcoming.

Who received the CEWS?

As of November 22, the CEWS had supported 3.9 million jobs at a cost of $50 billion. Back in March, the government projected the CEWS, then expected to only be in place for 3 months, would cost $71 billion. Clearly, uptake was not as expected.

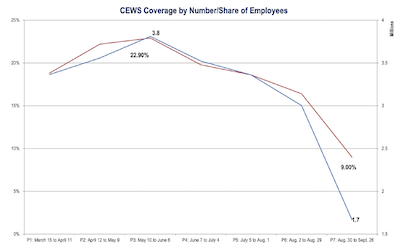

Many employers chose to lay-off employees instead of using the CEWS. By contrast, the CERB program paid-out over $81 billion in benefits to 8.9 million unique applicants. At its highest point, in period 3, the CEWS supported 3.8 million jobs.

Information about which companies received the CEWS is hard to come by. Unlike the United States, which publishes the recipients of the payroll protection program in a searchable online database, the CEWS is much less transparent.

Publicly traded companies, however, do disclose when they receive government funds. Air Canada received $492 million from the program and Imperial oil received $120 million. Indeed, the top 20% of CEWS recipients identified by the CBC received a combined $1.7 billion. While 390 approved applications were for over $5 million, the vast majority of applications (95%) were for claims under $100,000.

The CEWS has been crucial for specific industries. Approximately 70% of CEWS funds went to the service sector, with the remaining 30% going to the goods-producing sector. 20% of CEWS funds supported jobs in manufacturing. In periods 2 and 3, 46% of all jobs in the manufacturing sector were supported by the CEWS.

CEWS coverage by

number/share of employees